Bold Measures Needed to Achieve IMF Targets

An incremental capacity of $500 million per month has been added to the textile sector through TERF, vide a 100 new projects.

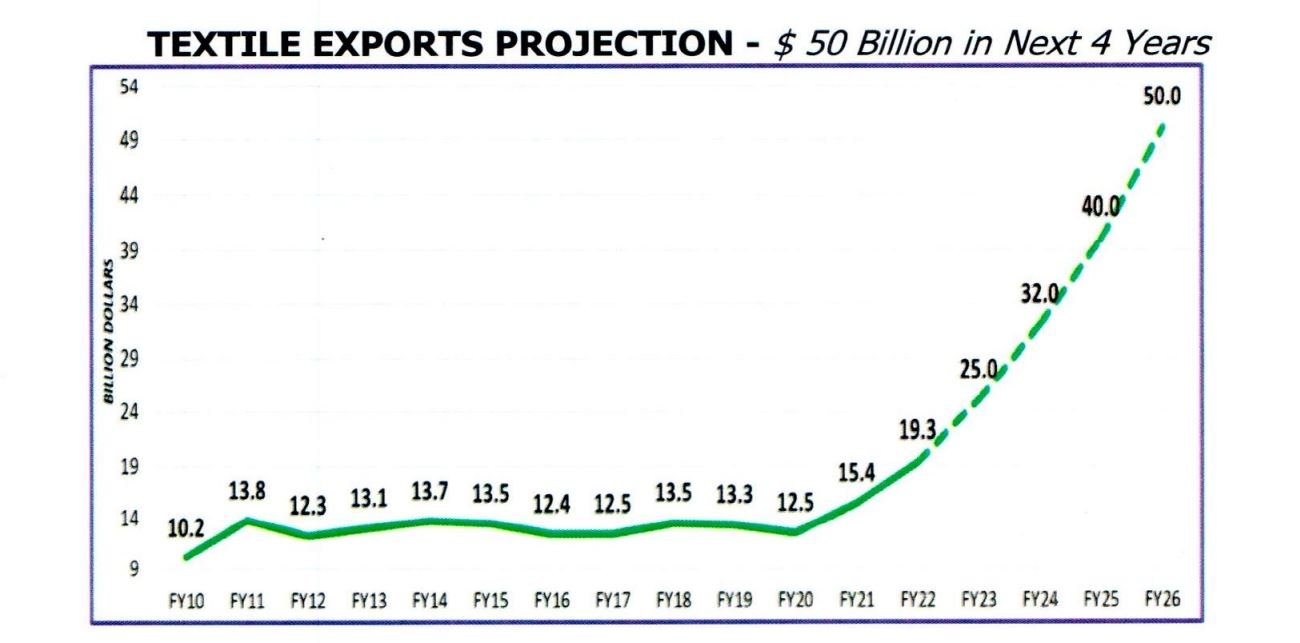

I write to you with regard to the recent IMF Agreement wherein the target for FY23 exports has been set at $35.5 billion. This level of overall exports requires textile exports to reach $24 billion ($4.5 billion higher than FY22) in FY23.

An incremental capacity of $500 million per month has been added to the textile sector through TERF, vide a 100 new projects. However, even the existing capacity is not fully utilized at present, due to energy supply and quality constraints (especially gas/RLNG) over the last 6 months. This inability to effectively leverage full capacity has reduced Pakistan’s exports by approximately $800 million per month, or $10 billion per annum.

We have set a target of achieving $50 billion in textile exports in the next 4 years.

At present, competition in textiles is becoming increasingly tough in the midst of the ongoing global recession. Inflationary pressures are increasing the price of inputs, thereby negatively impacting the competitiveness of exports. Price competitiveness and prompt delivery of quality products will therefore be increasingly instrumental in determining which countries are able to enhance or even maintain exports.

The textile industry commits to achieving the targets set, and is eager to contribute to Pakistan’s sustained economic growth. However, to maintain the current export level and subsequently increase as committed, the following issues must be resolved expeditiously:

1. Commitment on Long-Term Energy Rates

Gas/RLNG and electricity rates are being notified on a month-to month basis. It is of utmost Importance to commit energy rates for the entire year-if not for the full 4 years.

2. One Industrial Gas Tariff for the Country

Gas/RLNG for Industry needs to be set at levels which not only meet the commitment of the IMF deal but also eliminates discrimination and the unnecessary load of “subsidy” on the national exchequer.

3. First Priority to Export Value chain for Export Led Growth of the Country

At present, the textile sector of Punjab is only being provided 50 MMcfd of gas/RLNG for captive power and 25 MMcfd for processing. Punjab is host to 70% of the total installed capacity in Pakistan, and these plants require 200MMcfd gas/RLNG to operate at full capacity. Given the quality of grid supply and the delay in expansion of electricity connections, the supply of adequate gas/RLNG becomes critical.

The Industry share in gas/RLNG consumption has declined to 16% from 19% just a year ago. The government is urged to restore the priority of the exporting sector and to evaluate and ensure the best use of the scarce resources for the economic stability of Pakistan.

4. Supply of Gas/RLNG to New Units + Expansion

As of now, the textile industry is allocated gas on the basis of 50 percent of their consumption during September, October and November last year without any provision for additional supply due to expansion or for new projects. As a result, new projects and expansions have not been energized since November 2021 due to non-provision of energy.

The existing sanctioned load caters for the expansion of the new projects which had no consumption during the applicable reference period of September to November 2021. Shifting the basis for allocation of gas/ RLNG to sanctioned load from actual consumption will allow the expanded capacity to start production.

The basis for gas allocation should be changed to 50% of sanctioned load rather than the arbitrary figure of 50 percent of September, October, and November consumptions.

5. Working Capital Requirement

Despite the fact that our currency has depreciated by 60-70% within the last year, exports have become worth over Rs. 3 trillion, yet the working capital has not increased. In fact, 50% more working capital is needed to cover the gap created by exchange rate depreciation, The Industry requires double the amount of working capital that is currently available. This is further exacerbated by the situation where in order to Impose sales tax on domestic sales of textiles, the whole sector gets roped into a vicious cycle of unpredictable refunds.

The export cycle lasts up to 5-6 months wherein the liquidity of the sector remains tied up in the process of sales tax till refund (6 months).

In FY22, the total amount retained by FBR as sales tax on domestic sales was Rs 60 billion out of Rs 249 billion collected. Over Rs 250 billion liquidity of the industry remains with the FBR at all times as a result of this collection and refund mechanism. 4

. Sales tax is on consumption basis, which inflates inventory and capital costs, creating an impediment to new projects as capital cost increases by 20 percent and refund can only happen after commercial operations.

According to a report by the IMF, the cascading effect of GST has harmed Pakistani exporters’ competitiveness as there is currently no systemic method to ensure that all tax paid on inputs may be charged against a final sale is refunded. This huge cycle of sales tax collection and refunds, exporters suffer in the form of delayed pending and deferred refunds.

.The cost of collecting and refunding sales tax outweighs the revenue collected by a significant margin. The administrative cost of collecting and refunding sales tax is estimated at Rs 10 billion. The imposition of sales tax has resulted in billions (over Rs. 300bn) of rupees in liquidity transferring from the industry to the FBR.

a) It would therefore be prudent to restore the SRO 1125 l.e. Zero Rating for the entire textile value chain in order to meet the working capital requirements. This policy measure in combination with the continuation of RCET would be essential in enabling the textile sector to continue on its journey to achieving its FY23 target of $24 billion.

b) Enhance working capital facilities to cater for the increased requirements.

6. Hindrance-Free Import of Essential Inputs

Imports under Chapter 84 and 85 are restricted. Exporters have been unable to clear goods for up to 3-4 months. The State Bank informed that imports under Chapter 84 and 85 will only be cleared for top direct exporters.

Given the nature of the textile sector export sector in Pakistan, the input of intermediate goods is sourced from various enterprises across the value chain. These Indirect exporters need to keep operating for the sector to sustain and expand exports. It is therefore essential that all imports of the export oriented sectors, whether in Chapter 84, 85 or other codes, be allowed hindrance free admission into Pakistan.

The impact of the delay in clearance of the last 2-3 months will be significant, and further damage to the export potential has to be avoided at all costs.

Inputs of export-oriented units should not require pre-approval of SBP as this will cause delays and bureaucratic hurdles.

7. Sustained Growth

- Under our new scheme to enhance exports, the textile sector has committed to set up 1000 garment plants.

- The total investment would be US $7 billion over the next 4 years, generating exports of $20 billion annually and providing employment to well over 700,000 workers. 1000 garment plants are to be established near major textile producing cities i.e. Lahore, Sheikhupura, Faisalabad, Kasur, Multan, Sialkot, Rawalpindi, Karachi, Peshawar.

- To enable successful outcomes of this scheme it is extremely important to train women to contribute to various stages of the value chain e.g. stitching, weaving etc., and to bring them into the workforce.

To this end, women should be trained in the garment sector on a war footing to ensure long-term growth. In this context TEVTA should be tasked with training female labor force to meet the needs of the garment sector. In this regard, APTMA will facilitate and support the relevant institution, as well as provide master trainers.

APTMA is committed to collaborate in any way possible to achieve export-led growth.