FBR Sent 12m Tax Notices But Raked in Tiny Revenue

Senator Kamil Ali Agha said notices are served on defaulters but withdrawn due to corruption of tax officers

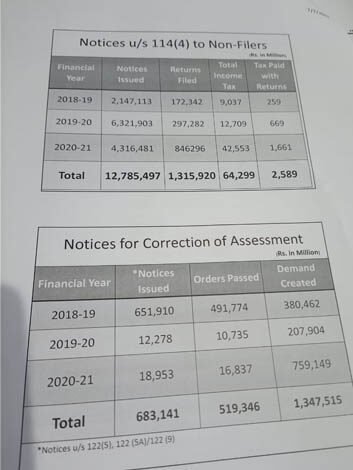

The Federal Board of Revenue (FBR) served more than 12 million tax notices during the last three years but could only generate revenue worth Rs 2.58 billion.

According to the documents available with News360, FBR dispatched more than 12 million notices to tax defaulters between 2019 and 2021.

However, only 1.3 million defaulters filed tax returns worth Rs 2.58 billion during the span against the estimated figure of Rs 64 billion.

Read Also

FBR Ordered to Return Naulong Dam Funds Cut as Arrears

The documents read that FBR issued 2.147 million notices in the fiscal year 2018-2019 while some 6.3 million notices were served on the defaulters next fiscal year.

Similarly, the figure of caution paper stood at 4.3 million in the fiscal year 2020-2021.

The documents read that the tax generated from 1.3 million returns should have been Rs 64 billion as estimated.

In this regard, Senator Kamil Ali Agha, a member of Senate Standing Committee on Finance, said the FBR sends notices to defaulters but the tax officers do corruption.

He said that due to unscrupulous elements in FBR, the tax notices are withdrawn after sending and the revenue targets are not met.

The senator wondered why the charitable nation doesn’t submit taxes.

He expressed the government needs to dig out the answer to it. FBR already knows that its officials harass the taxpayers, the senator added.

Kamil Ali Agha said the tax filers are the ones who suffer while the defaulters live at ease.