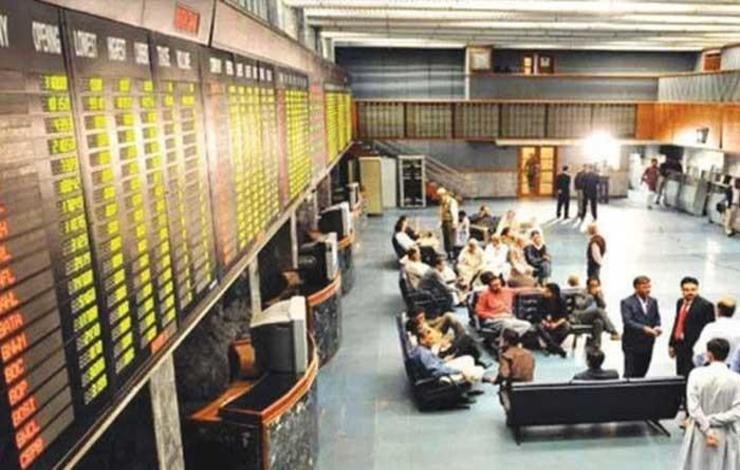

Proposal to Demote PSX, Current Account Deficit Rose In May

MSCI proposes to demote PSX to Frontier Market (FM) from Emerging Market (EM) while Pakistan's current account deficit swells in May

Morgan Stanley Capital International (MSCI) has proposed to demote Pakistan Stock Exchange (PSX) to Frontier Market (FM) from Emerging Market (EM) while Pakistan’s current account deficit rose in May owing to the lockdown situation and fall in exports and remittances.

According to Investopedia, “Countries with an emerging market economy used to be referred to as “less economically developed countries” (LEDCs)”.

These markets are also more stable than frontier markets and offer more liquidity and stability. The final decision on MCI’s proposal will be made public in September.

Read Also

IMF Validates Tarin, Sheds Fear That Program is Halted

The proposal has come forward when three local companies failed to meet the criteria of size and liquidation of EM since 2017 when PSX received up-gradation.

#MSCI to start consultation to reclassify #Pakistan to frontier market. Please find below details #MSCI #EM #FM #KSE100 #PSX @MSCI_Inc @pakstockexgltd pic.twitter.com/hqfEpEvOLC

— Arif Habib Limited (@ArifHabibLtd) June 24, 2021

The global capital firm will discuss down-gradation with market players by August 31.

Pakistan was promoted to EM from FM in May 2017 after 9 years.

Further, the current account deficit in May rose to $632 million compared to $188 million in April.

The surge in deficit has emerged due to partial lockdown, week-long Eid holidays, and slash in exports. The inflow of remittances also remained moderate during the last month.