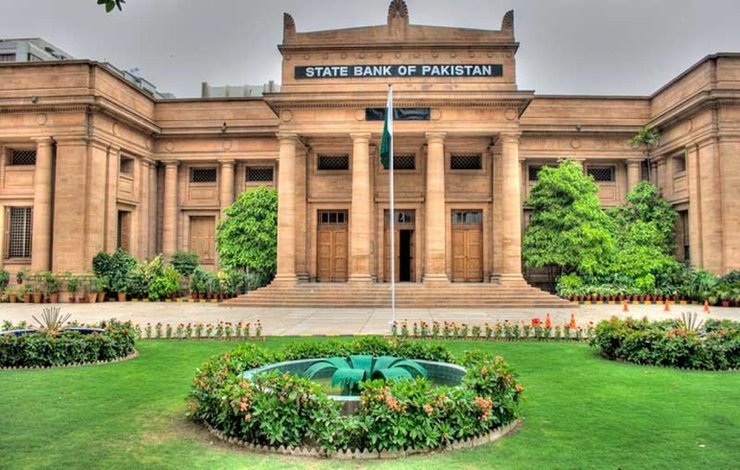

The State Bank of Pakistan (SBP) Governor will be hosting a webinar to discuss reducing the gender gap in a bid to encourage women to become part of the financial system by opening bank accounts.

The webinar aims to promote awareness of the significance of women’s financial inclusion and hold discussions with distinguished international leaders to discuss practical ways to give a boost to women’s financial inclusion in Pakistan.

‘We need to do more to reduce exclusion of women in financial system. Only 18 in 100 women have an active bank account and fewer have access to credit,’Dr. Reza Baqir, Governor SBP. #SBP is launching a national dialogue on #BankingonEqualitypolicy to promote #financialinclusion. pic.twitter.com/MKhJkY1tst

— SBP (@StateBank_Pak) December 20, 2020

SBP Governor Reza Baqir will host the consultative launch where women’s access to financial and economic opportunities will be discussed.

The panel will comprise of Aga Khan Development Network Director Zahra Aga Khan, Ceyla Pazarbasioglu from IMF, and Anita Zaidi from Bill and Melinda Gates Foundation.

Women’s access to financial and economic opportunities is essential for sustainable and inclusive economic growth in Pakistan. However, women in Pakistan are disproportionately underserved in the existing financial system.

Only 18% of adult women in Pakistan have an active bank account compared with 51% of men. Comparatively, some 50% of women in Saudi Arabia and 90% in Iran have bank accounts.

The major reason for the low female percentage of bank account holders is that two identification documents are required to open a bank account. However, a huge number of women, both single and married, in rural areas and even in urban centers do not have national identity cards (NICs) and marriage certificates.

Besides, to obtain these documents is a long-haul therefore most of the women do not get them due to societal pressures, lack of awareness, and slowness in the process.

The majority of women in our society are financially dependent on males and to this day, opening a bank account is still considered a daunting task.

To promote women’s independent role in the financial system, the State Bank of Pakistan has adopted a medium-term national target of 20 million active women bank accounts by 2023 under the national financial inclusion strategy.

The overall literacy rate of women in Pakistan is still 45% which is the lowest in the region.

The healthcare system is also discriminatory and does not offer the same facilities to women as men.

The employment ratio of women is 48% which is disheartening for the economic growth of a country.

Pakistan’s constitution prohibits discrimination by every means but still, many issues encourage inequality and financial dependence is also one of them.

Read Also

Walmart-TikTok Close to Strike A Business Deal

According to an International Monetary Fund (IMF) report, there is an overall decline in the gender gap but female participation is still far less than males as they do not get the same opportunities that make them dependent on men for financial assistance.