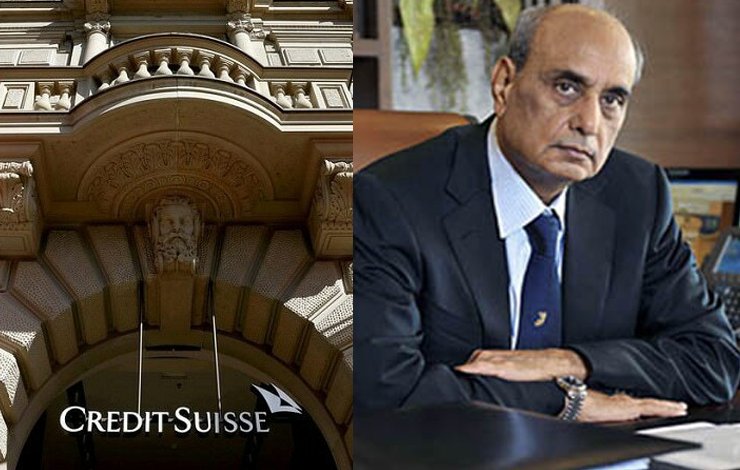

Credit Suisse leak revealed Mian Mansha’s undeclared offshore wealth, says report

The Credit Suisse leak has revealed that undeclared offshore wealth of Mian Mansha alongside other prominent figures of the country.

The Credit Suisse leak, the secret banking data from a Swiss bank, has revealed the undeclared offshore wealth of Pakistan’s richest man, Mian Mansha, alongside other prominent figures of the country.

Pakistan’s richest person Mian Muhammad Mansha, who has been named in almost every offshore leak reported so far, is now named in the OCCRP’s Credit Suisse, reported FactFocus which is a partner of the Organized Crime and Corruption Reporting Project (OCCRP) that published publishing Swiss banking records.

Mian Mansha, who is considered close to the political party PML-N and its top leadership, was not only hiding his Swiss bank accounts from the tax authorities in Pakistan but the #SuisseSecrets revelation have also raised serious questions on his denials of having any link with the purchase of a luxury hotel in London in 2010.

Mian Mansha had opened two accounts in the Swiss bank Credit Suisse in the year 2005.

The first account was opened by Mansha, 74, and his wife Naz Mansha, 73, on February 14, 2005, which has a maximum balance of 498,811 Swiss Francs on October 30, 2005.

Yet another account was opened in the same year on October 06, 2005. The account holders of this second account were three; 1. Easy Investment Ltd 2. Mian Mohammed Mansha 3. Naz Mansha. This account had a maximum balance of 18,519,551 Swiss Francs on September 30, 2012.

WEB OF MANSHA’S OFFSHORE COMPANIES

Paradise Leaks and another Swiss bank account

Mian Muhammad Mansha, Chairman of Nishat Group was linked with six offshore companies in Paradise Leaks. Four of them were in the British Virgin Islands: Mallen Securities Ltd, Maple Leaf Investments Ltd, Lyle Trading Ltd, and Dolin International Limited.

The remaining two were in Mauritius: Croft Limited and Best Eagles Holdings Inc. An account in a Swiss bank has also been found connected with these companies which dated back to 1994 and the account was in existence till 2007.

It is interesting because this account is not reported in the OCCRP’s #SuisseSecrets so this is a Swiss account in some bank other than Credit Suisse. This also establishes the fact that Pakistanis have maintained bank accounts on different Swiss banks, according to FactFocus.

Pandora Papers

Among the Pakistani individuals with accounts in a Swiss bank, either created in their own name or through offshore companies, Mian Muhammad Mansha was named in Pandora Papers.

Hiding Swiss accounts

While it has been established that Mian Mansha and his wife were maintaining two bank accounts from 2005 to 2013, a careful perusal of the tax record of the couple shows that both of them were hiding these Swiss accounts from tax authorities in Pakistan.

Here is a year-over-year description of what Mian Mansha and his spouse have declared with the Federal Bureau of Revenue (FBR) in Pakistan.

2009

Naz Mansha

She mentioned only one bank account in her tax filing with an amount of Rs803,376,729 in the Royal Bank of Scotland, Egerton Road Branch, Lahore.

2010

Mian Mansha

Net Wealth: Rs47,024,680

Only bank accounts declared were three MCB Bank in Pakistan having amounts Rs4,534,673, Rs26,720, and Rs83,910

2011

Mian Mansha

Net wealth: Rs50194,848

Only bank accounts declared were three MCB Bank in Pakistan having amounts Rs6,228,337, RS26,744 and Rs1,560,390

Naz Mansha

Total Assets 1,965,719,841

Three bank accounts were declared. One was a USD account in Barclays Bank, Lahore, Pakistan having an amount equal to Rs58,514. Another Pak Rupee account in Barclays Bank Lahore had a balance of Rs22,826,571. The third account in Royal Bank of Scotland had a balance of Rs3,524,698

2013

Mian Mansha

Net Wealth: Rs49,363,806

Only bank accounts declared were three MCB Bank in Pakistan having amounts Rs1,163,107, Rs26,769, and Rs1,638,889.

Naz Mansha

Total Assets: Rs2,203,450,827

Only four bank accounts in Pakistan were declared. No foreign bank account was declared. An account in Barclays Bank Lahore had a balance of Rs55,535. Another account in Barclays Bank Lahore has a balance of Rs20,882. A third bank account in the Royal Bank of Scotland had a balance of Rs275,447. Yet another bank account in MCB had a balance of Rs936,626.

Mian Masha’s denials for owning a five-star London hotel

Tax authorities in Pakistan began investigating Mansha and other members of his family in 2015 after they came to suspect irregularities in the US$46.74 million purchase of the historic St. James Hotel & Club of London in November 2010.

Mian Mansha categorically denied having any link with the purchase of the hotel and have been maintaining this position for many years.

Sons of Mian Mansha have been under scrutiny by the Federal Board of Revenue which wanted them to explain the source of funds. Mansha had distanced himself from the deal when summoned by the FBR.

He said he didn’t have any financial stake. Umer and Hassan, his sons, said their Singapore-based company (Residentia Holdings PTE Limited) obtained a loan from two companies in British Virgins Islands and Guernsey. The FBR wrote to both jurisdictions; only Guernsey responded and said the company under reference, Easy Investments Ltd, never existed there. That made the whole transaction suspicious.

Now leaked data reveals that one Easy Investments Ltd has a joint account with Mian Mansha and Naz Mansha. The couple held two accounts that appeared in the data and one of them was the company account that they co-held with Easy Investments Ltd. Balance in this account swelled to 18.5 million Swiss francs in 2012.

Information shared by the family with the FBR said the Easy Investment granted a loan of $20 million in late 2010 whereas this account received a balance close to that amount two years later. It remains unexplored whether the financing was done through this company or is it just a name-sake.

Mansha did not respond to questions from journalists. Neither he nor his family members have been charged with any crimes related to the deals.

Mansha recently stepped down as chairman of Nishat Group, a conglomerate founded by his father and uncles in 1951. In 2010 he became the first Pakistani to make the Forbes list of billionaires.

But bank records obtained by OCCRP and partners in the Suisse Secrets investigation have possibly linked him to the hotel acquisition for the first time. They reveal that prominent businessman Mian Mohammad Mansha may have held a joint Swiss bank account with a mysterious company that financed the deal.

Though Mansha himself has insisted he was not involved in the purchase, which his sons, Umer and Hassan, and daughter-in-law, Ammil Raza Mansha, claimed to have financed with $22 million borrowed from an obscure offshore company in the British Virgin Islands, and $20 million borrowed from another offshore in the British Crown Dependency of Guernsey.

Both loan agreements were signed by Hassan Mansha and witnessed by Muazzam Rashid, an assistant manager at a Mansha family-owned business in Pakistan.

But the Federal Board of Revenue investigation, which focused on potential offshoring of funds in violation of Pakistani law, soon reached a dead end, since investigators couldn’t learn anything about the offshores that supposedly lent the money.

British Virgin Islands officials didn’t provide any information about the company registered there, Avendale Enterprises Limited, which had supposedly lent the Manshas $22 million.

Guernsey officials were more helpful, but their response, when queried about Easy Investments Limited, raised red flags. They said there was no record of any such company ever having been registered in Guernsey. Pakistani investigators didn’t find a trace of it anywhere else in the world either.

OCCRP found there were three other Easy Investments registered at the time around the world – in the UK, and in Africa and Asia. The UK company, the country where the hotel is located, looks to be a shell company with nominee leadership. Its ownership is likely unobtainable. The other two companies are not likely related to the deal.

In fact, the only likely places where the company appears to exist are in the bank records obtained by OCCRP and partners or as the London company with hidden owners. The two may in fact be related to the same company.

It can’t be definitively proven that the company listed on the bank account is the same as the offshore that loaned the Mansha family money since Suisse Secrets data does not include the jurisdictions where corporations are registered. Reporters found a handful of companies named Easy Investments Limited registered at the time of the deal in other jurisdictions around the world, but either their owners could not be identified, or they did not appear to be connected to the deal.

But Maira Martini, a policy expert at Transparency International, told OCCRP the Suisse Secrets data indicated that Mansha must have a close relationship with a company called Easy Investments Limited.

“It would not be possible for somebody else to be listed as the [co-]owner of your account if you don’t have anything to do with them and you’ve never met them,” she said. “Everything in the account belongs to both of you.”

OCCRP’s information from the #SuisseSecrets raises serious questions and there are clear indications that Mansha had an intimate financial link to the financing of the hotel. Mansha and his wife, Naz, opened a joint bank account at Credit Suisse in 2005 that named Easy Investments Limited as a co-holder. The account, which was closed in 2013, had a maximum balance of around 18.5 million Swiss francs (about $20.32 million) in 2012, two years after the hotel deal was concluded. The source of the money and similarity to the amount of the purported loan two years after the hotel purchase remain unexplained.

In court papers filed in 2020, the Federal Board of Revenue argued that Guernsey’s lack of a registration for Easy Investments Limited rendered the multi-million-dollar loan suspicious and raised “serious questions regarding the veracity of the claims of members of the Mansha family.” The agency accused the family of deceptively spreading the transaction over several jurisdictions to obscure their sources of funding.

The Manshas have challenged the tax agency’s jurisdiction because Residentia Holdings PTE LimitedM/s RHPL, the subsidiary holding the hotel, is a foreign entity. They also questioned the jurisdiction of the National Accountability Bureau, which is pursuing a separate case over suspicion that the deal involved money laundering.

But the new revelation about Easy Investments could change the course of these investigations.

If Mansha secretly owned the company and lied to investigators about it, he could be on the hook for serious financial penalties — and even perjury charges, a tax official who worked on the investigation told OCCRP.

“If the information is supported by documentary evidence, then he will have to pay the relevant taxes plus penalties on the evaded amount,” said Haroon Muhammad Khan Tareen, who launched the Mansha investigation in 2015. He is now retired.

“He may also face criminal prosecution for concealment,” added Khan Tareen.

Mansha is the chairman of Nishat Group, founded in 1951 by his father and uncles. He joined the family business in 1968 after the death of his father. In 2010 he became the first Pakistani to make the Forbes list of billionaires.

Mansha’s wealth grew even greater in the 1990s when he acquired Muslim Commercial Bank, Pakistan’s third-largest, and two cement companies during the privatization drive led by the then Prime Minister Mian Nawaz Sharif.

Questions are still being raised about the acquisition of the bank. Mansha’s bid was not the highest submitted, but he was allowed to match the high bid to win the auction. A NAB investigation launched in 2002 remains open.

Mansha is said to be close to Sharif, who was disqualified from public office in 2017 in the wake of public corruption charges. Mansha’s 240-acre estate is in the same neighborhood as that of the former prime minister.

In 2021, Mansha’s bank was implicated in a case described by authorities as “organized mega-money laundering” involving a sugar mill owned by Main Shehbaz Sharif, who is the leader of the main opposition party in Pakistan’s National Assembly. The Federal Investigation Authority has alleged that the bank facilitated money laundering by allowing capital flight through the accounts of the mill’s employees.