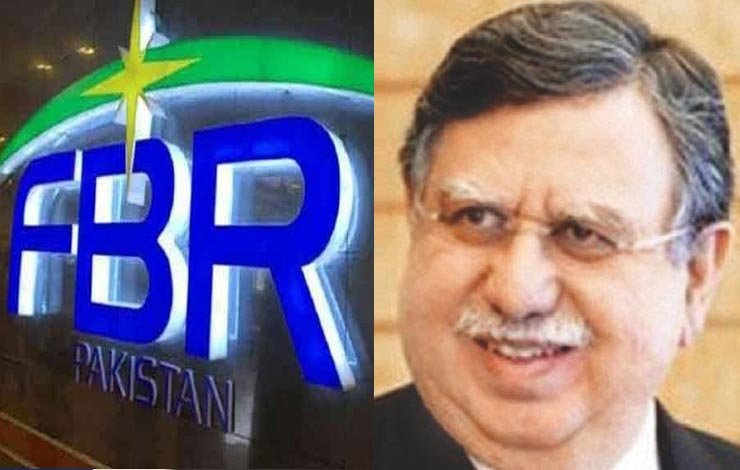

Shaukat Tarin launches formulation of Inland Revenue Code

The code will harmonize all inland taxation laws and maximize facilitation of taxpayers.

Shaukat Tarin, the adviser to PM on finance and revenue has launched the formulation of Inland Revenue Code in a bid to harmonize all inland taxation laws and maximize facilitation of taxpayers. It aims to remove multiplicity of tax statutes and rules.

In a watershed development, Mr. Shaukat Tarin, Advisor to PM on Finance & Revenue has launched the formulation of Inland Revenue Code in a bid to harmonize all inland taxation laws and maximize facilitation of taxpayers. It aims to remove multiplicity of tax statutes & rules.

— FBR (@FBRSpokesperson) November 12, 2021

The finance adviser said that the purpose of creating inland revenue code is to eliminate the abundance of tax laws and rules.

He said that the regular start of the inland revenue code will be effective from July 1, 2022.

Also Read:

Rupee depreciates to historic low of Rs178 against dollar in open market

Fawad and Tarin’s claim all is well fails to provide relief to masses

According to the details, on the directives of Shaukat Tarin to create the code, the FBR chairman completed the consultation process with all stakeholders to prepare the draft.

Briefing on the code, the FBR spokesperson said that the creation of the inland code will remove many complications in the tax system.

He said that several institutions, including the World Bank, IMF and ADB were demanding ease of tax laws.

He added that four major tax laws are currently applicable in the country, which included the Income Tax Ordinance 2001, Sales Tax Act 1990, Federal Excise Act 2005 and Islamabad Limits (sales tax on services) Ordinance 2001. The government has decided to combine all four laws in a book.

A committee has been formed in collaboration with the Asian Development Bank, Tarin said. The committee includes the country’s best economists and legal experts. The committee will oversee the preparation of the inland review code and all laws will be completed by March 2022.

It is to be mentioned here that on November 8 while addressing the youth convention in Islamabad Shaukat Tarin had said that no FBR official will harass businessmen now.